The Long Road to “Mutual Funds Sahi Hai” – A History of Mutual Funds

Dec 24, 2025

SEBI recently revemped the way Mutual Funds incur and report expenses. But this is not the first time that major reforms have been carried out in the mutual funds space. In this piece, we cover the history and evolution of Mutual Funds in India

“Mutual funds sahi hai” - the motto is now very popular, but did you know that the story of mutual funds in India goes back all the way to the 1960s?

Over the decades, the industry has evolved alongside India’s economic reforms, regulatory changes, and growing financial awareness among retail investors. Let’s take a quick walk through history and see how mutual funds in India evolved across five distinct phases.

The Origins: UTI and the first phase (1963-87)

In 1963-64, the Parliament established the Unit Trust of India (UTI) through a special Act. This marked the inception of mutual funds in India. UTI launched its first scheme, Unit Scheme 1964 (US-64), which became immensely popular and laid the foundation for collective investment in India.

In its early years, UTI operated under the administrative control of the RBI, and later the IDBI. For over two decades, UTI remained the sole mutual fund provider, with no formal regulatory oversight regarding fee disclosures or product structuring in the modern sense.

For an entire generation of Indian households, UTI became synonymous with mutual fund investing, long before the term itself became popular.

II. Public Sector Expansion (1987-93)

In 1987, The first non-UTI mutual fund was launched by the State Bank of India in Jun’87, opening the door for public sector banks.

This was followed by funds from other banks — Canara Bank, Punjab National Bank, Indian Bank, Bank of Baroda — and insurance entities like LIC and GIC.

This was the end of UTI’s monopoly, although the sector was still heavily dominated by government entities.

III. Liberalization and Entry of Private Sector (1993-03)

Following the economic reforms of the early 1990s, in 1992, The Securities and Exchange Board of India (SEBI) was established as India’s capital market regulator.

In 1993, the first SEBI Mutual Fund Regulations were issued, requiring mutual funds (other than UTI) to register with SEBI. Kothari Pioneer became the first private sector mutual fund in India, signaling entry of private and foreign financial firms.

AMFI was incorporated in August 1995

A revised and comprehensive set of regulations — SEBI (Mutual Funds) Regulations, 1996 — replaced the earlier framework, introducing structured norms for disclosure, governance, trustee obligations, and investor protection

This period saw rapid increase in the number of fund houses, broader product offerings including equity, debt, and balanced funds; besides growing awareness among investors of mutual fund benefits. By January 2003, there were 33 mutual funds with total AUM crossing ₹1.2 lakh crores.

* If you are wondering what happened to Kothari Pioneer, they were acquired by Franklin Templeton in 2002.

IV. Reform and Restructuring (2003-10)

In February 2003 the Unit Trust of India Act, 1963 was repealed. UTI was bifurcated, to modernize governance and align UTI with industry practice, into:

Specified Undertaking of UTI (SUUTI) — holding certain legacy schemes.

UTI Mutual Fund — a SEBI-registered entity operating under mutual fund regulations.

While the 2008 Global Financial Crisis dented investor confidence, it also triggered deeper regulatory introspection. SEBI responded with key reforms, most notably the removal of entry loads in 2009, significantly improving transparency and cost efficiency for investors., such as the removal of entry loads.

During this period, mutual funds started to establish a more formalized fee disclosure regime, systematic pricing, and clearer investor rights

V. Mass Retailization and Rapid Growth (2010-Present)

From the mid-2010s onwards, mutual funds entered a high-growth phase.

2012-14 reforms: SEBI implemented measures to enhance mutual fund penetration, including investor education, standardized risk measures, and simplification of KYC processes.

AUM milestones: ₹10 lakh crores crossed in 2014, 20 in 2017, 30 in 2020 and ₹80+ lakh crores by 2025, with ~25+ cr investor accounts.

SIPs: While SIPs were introduced by Franklin Templeton in 1993 in India, their rapid growth started in 2010s. It became a defining feature of the industry, enabling regular, disciplined investing across income groups. Monthly SIP flows were ~₹1,000 crore in 2010 and grew to ~₹8,000 crore in 2020 and are now nearing ₹30,000 cr in November 2025.

AMFI and digitization: AMFI played a proactive role in promoting professionalism, ethical standards, investor education, and consistent reporting practices across AMCs. While digital platforms, e-KYC, mobile investing apps, and automated platforms accelerated access, especially in Tier II and III cities, thereby widening the investor base.

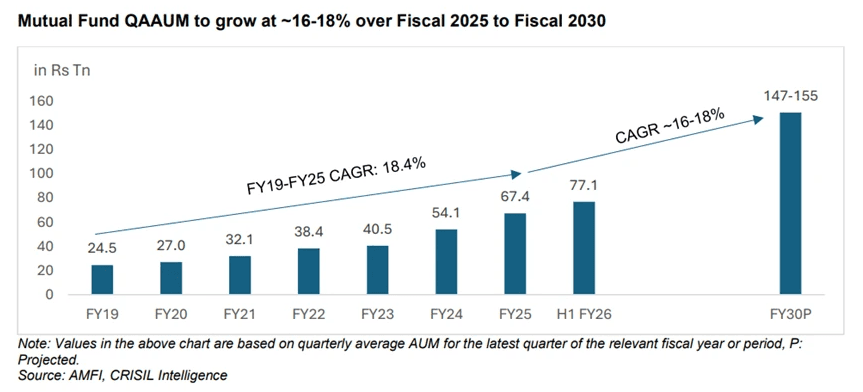

Over the last decade, mutual funds in India have grown at a rapid pace, with AUM compounding at ~18% annually between FY19 and FY25. CRISIL Intelligence expects this growth momentum to continue through 2030, potentially taking industry AUM beyond ₹150 lakh crores.

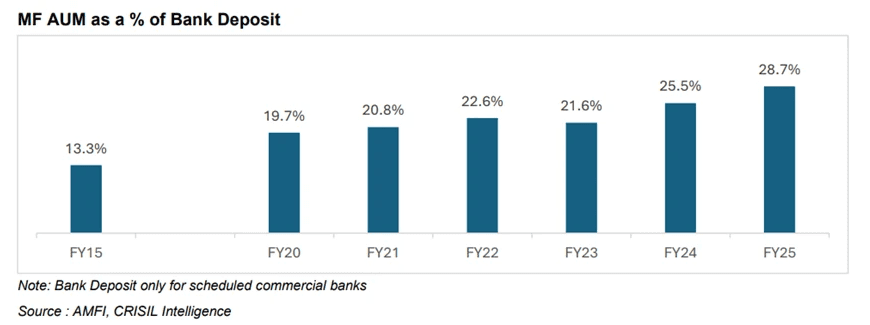

With bank deposit rates moderating and inflation averaging 5–6%, investors are increasingly turning to market-linked instruments in search of better long-term returns. This structural shift is evident in the steady rise of mutual fund AUM as a percentage of scheduled bank deposits - from 13% in FY15 to nearly 28% in FY25.

What began as a single institution-led initiative in the 1960s has today evolved into a vibrant ₹80+ lakh crore industry in 2025, democratizing investments through regulatory reforms, investor education, and the SIP revolution.

Mutual funds now form a cornerstone of Indian personal finance, empowering millions to participate in capital markets. We at Creso - Powering India's Next-Gen Mutual Fund Distributors are trying to make a dent in this industry by empowering distributors to support their clients’ wealth creation journey in an easy, smooth and a tech-first manner.

Read more from our Blogs

Feb 2, 2026

The Union Budget 2026 - Takeways for Mutual Fund Distributors

Jan 28, 2026

Decoding Debt Mutual Funds (Part III – The Decision Making)

Jan 27, 2026

Decoding Debt Mutual Funds (Part II - Where they stand in the fixed income landscape?)

Jan 26, 2026

Decoding Debt Mutual Funds (Part 1 – The Basics)

Jan 27, 2026

The Retail Tsunami: Dissecting 6 Years of Mutual Fund Growth (2019-2025)

Jan 5, 2026

Changes in Fund Manager - December 2025

Dec 26, 2025

Know Your Mutual Fund House (SBI MF)

Jan 16, 2026

Less Is More: A Simple Take on Focused Mutual Funds

Dec 31, 2025

Our Mutual Fund Ranking Framework

Jan 19, 2026

Turn Mutual Funds Into Monthly Income (Part 3 - Key SWP Decisions)

Jan 19, 2026

Turn Mutual Funds Into Monthly Income (Part 2 - Systematic Withdrawal Plans - Reverse SIPs)

Jan 19, 2026

Turn Mutual Funds Into Monthly Income (Part 1 - Stocks Give Dividends, Mutual Funds Have IDCW)

Dec 5, 2025

Changes in Fund Manager - November 2025

Dec 4, 2025

Coffee with Creso: Spark more client conversations, one coffee at a time

Dec 1, 2025

You’ve Checked the Returns - But Have You Checked the Taxes? (Part 3 - Taxation for NRIs)

Jan 19, 2026

Going Global: How Indian Mutual Funds Let You Invest Beyond Borders

Nov 19, 2025

You’ve Checked The Returns, But Have You Checked The Taxes? (Part 2: Making Smarter Choices)

Nov 18, 2025

You’ve Checked the Returns, But Have You Checked the Taxes? (Part 1:The Basics)

Oct 14, 2025

How Clients Can Change Email or Mobile on MFCentral (Guide for MFDs)

Sep 3, 2025

GST 2025 for MFDs and Insurance Agents: What Changed, What Didn’t

Aug 28, 2025

How to Open a Minor’s Mutual Fund Account in India

Aug 3, 2025

Change of Broker in Mutual Funds

Partners in prosperity