Decoding Debt Mutual Funds (Part III – The Decision Making)

Jan 28, 2026

In Part 3 of the series, we look at how to select the category that best suits an investor and how to select the right funds within that category.

We have learnt about debt mutual funds and its sub-categories, the risks and benefits of debt mutual funds and key events in recent history in our Part 1 and Part 2 of the series ‘Decoding Debt Mutual Funds in India’. Before we move on to the decision-making process, let us debunk a few myths surrounding them.

The Myth | The Reality | The Detail / Context |

|---|---|---|

Debt Funds are risk-free. | Low Risk, NOT ZERO Risk | Unlike bank Fixed Deposits (FDs) which have insurance up to ₹5 lakhs, debt funds carry credit risk (default), interest rate risk (price fall if rates rise), and liquidity risk. |

Returns are guaranteed | Returns are Market-Linked | YTM is an estimate, not a promise. If interest rates spike or a bond defaults, your actual return can be lower than the YTM, or even negative. |

All Debt Funds are the same. | Massive Risk Variance | An Overnight Fund (safest) and a Credit Risk Fund (high risk) are as different as a Savings Account and the Stock Market. Grouping them together is dangerous. |

Liquid Funds cannot lose money | Liquid Funds CAN Lose Money | Historical Proof: In 2017, the Taurus Liquid Fund crashed ~7% in a single day due to a rating downgrade (to default rating) for Ballarpur Industries. They are stable, but not immune to shocks. |

AAA rating means 100% safe | Ratings Lag Reality | Ratings are opinions, often based on past data. IL&FS was rated AAA/A1+ right up until it defaulted in 2018, trapping many "safe" funds. |

Debt Funds are only for short-term parking | Strategic Wealth Creators | While Liquid funds are for parking, Long Duration or Gilt Funds may generate double-digit returns (10-12%) over 2-3 years if you enter before an interest rate cut cycle (although practically difficult to exactly time this). |

Which category of debt funds should I select?

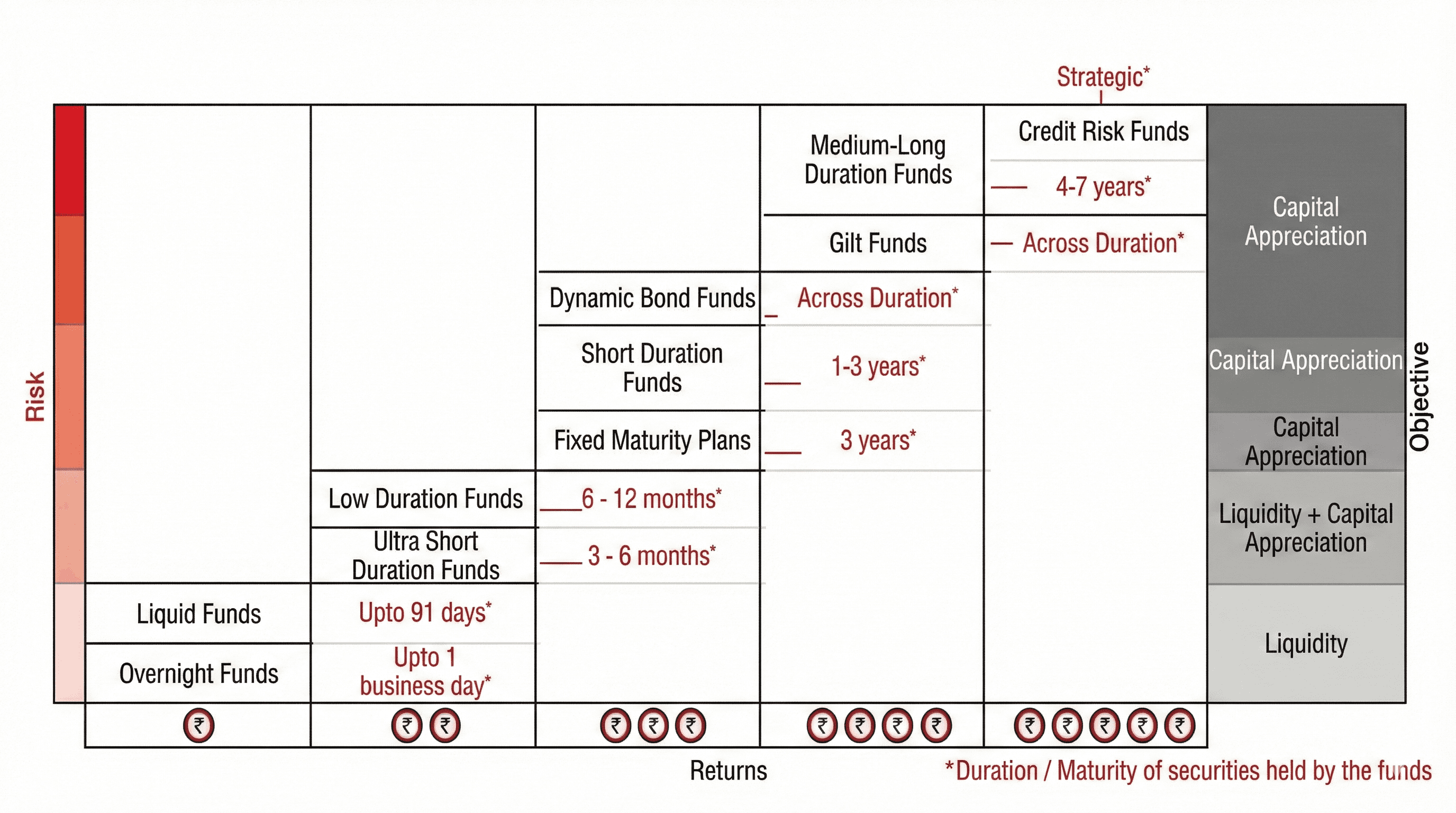

The selection of category would depend on your time horizon, intent (whether you just want stable income or capital appreciation as well), liquidity needs and so on. A matrix by HSBC Mutual Fund lays it out well:

Key takeaways:

As a thumb rule, fund’s duration should be close to your investment period/time horizon or slightly lower. Choosing a longer duration fund than your horizon can lead to you getting caught on the wrong side of the interest rate cycle and making poor returns.

As the duration/tenure increases, the sensitivity to interest rate also increases, implying a greater probability of capital appreciation (but greater risk as well).

Which Fund Should I select within the category?

Within each category, an investor should look at the following things, in addition to the overall returns, when selecting a fund:

YTM - compare the YTM to the category average. Beware that, if a fund's YTM is significantly higher than its peers (e.g., 8.5% vs 7.2%), it is likely taking higher credit risk.

Credit Risk - Minimising credit risk is key to protecting your capital. Hence for safety purposes, stick to funds with 90%+ in AAA, A1+ and SOV (Sovereign) papers.

AUM - AUM does matter in certain sub-categories like ‘Liquid’ or ‘Corporate Bond’ since larger AUM usually implies better negotiating power and liquidity buffers.

Portfolio Composition - One needs to also check the ‘Top 10’ holdings of the scheme to evaluate concentration risk. E.g., if 6-8% of the portfolio is invested in a single company or group could signal a potential concentration risk.

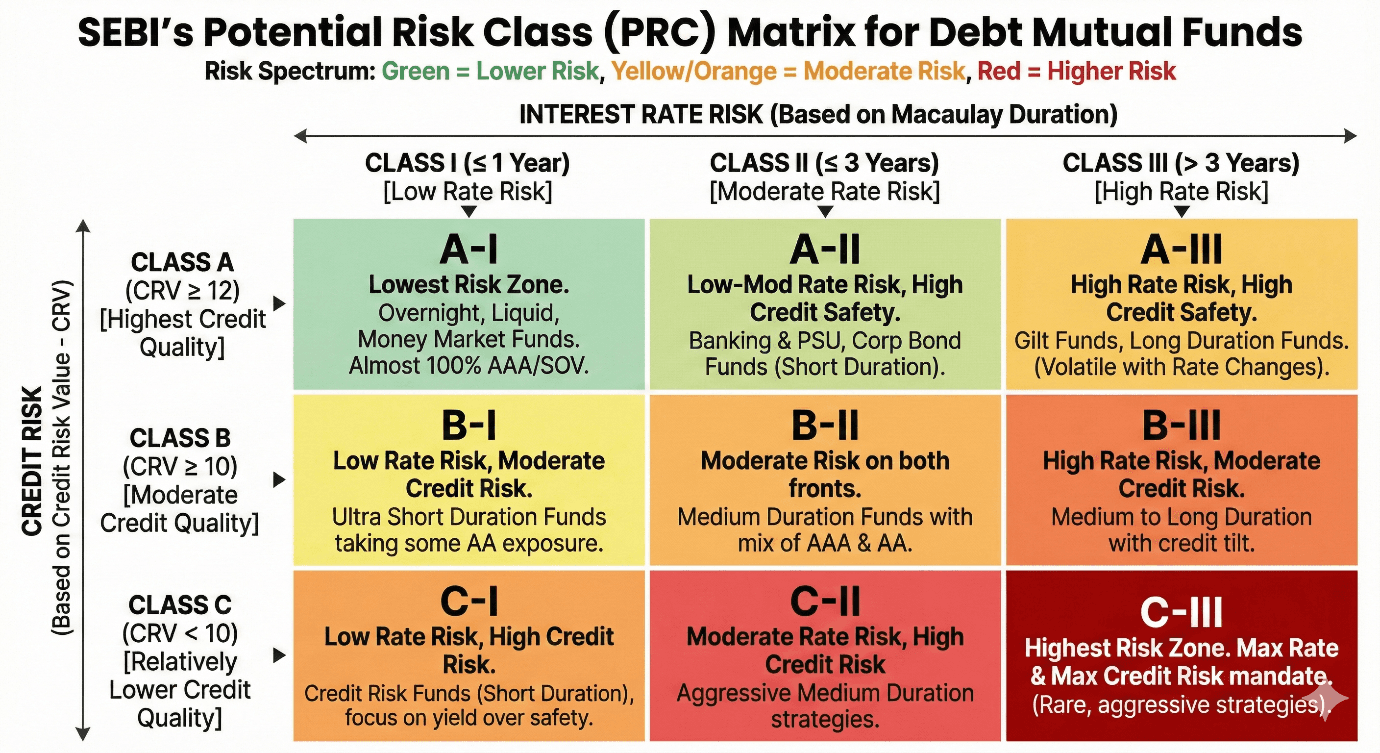

Potential Risk Class (PRC Matrix) - Every debt mutual fund is mandated to present a PRC matrix for its scheme in the fact sheet. Below is a sample PRC indicating various sub-categories mapped under the matrix.

Conclusion: Debt mutual funds in India represent a sophisticated alternative to traditional fixed deposits, offering superior liquidity, tax deferral in some cases and the potential for capital appreciation, but they demand a fundamental shift in mindset from "guaranteed safety" to "managed risk."

Unlike the static nature of FDs, these funds operate on a dynamic spectrum where returns are driven by the interplay of interest rate cycles and credit quality. While they serve as excellent tools for portfolio stability and income generation, historical precedents like the IL&FS crisis and the 2020 winding-up events underscore that they are not immune to credit defaults or liquidity freezes.

Therefore, successful investing in this asset class requires looking beyond past returns and strictly aligning the fund’s Modified Duration and PRC with your personal investment horizon, ensuring you are compensated adequately for the risks you choose to take.

Disclaimer: The information provided in this discussion is strictly for educational and informational purposes and does not constitute professional financial, investment, legal, or tax advice. Mutual fund investments are subject to market risks, including the potential loss of principal, and past performance is not a reliable indicator of future results. All specific fund names, historical events, or financial metrics mentioned are for illustrative purposes only and should not be construed as recommendations to buy or sell any security. You are strongly advised to consult with a SEBI-registered investment advisor or a qualified financial planner to assess your specific risk profile, tax bracket, and financial goals before making any investment decisions.

Read more from our Blogs

Feb 2, 2026

The Union Budget 2026 - Takeways for Mutual Fund Distributors

Jan 27, 2026

Decoding Debt Mutual Funds (Part II - Where they stand in the fixed income landscape?)

Jan 26, 2026

Decoding Debt Mutual Funds (Part 1 – The Basics)

Jan 27, 2026

The Retail Tsunami: Dissecting 6 Years of Mutual Fund Growth (2019-2025)

Jan 5, 2026

Changes in Fund Manager - December 2025

Dec 26, 2025

Know Your Mutual Fund House (SBI MF)

Dec 24, 2025

The Long Road to “Mutual Funds Sahi Hai” – A History of Mutual Funds

Jan 16, 2026

Less Is More: A Simple Take on Focused Mutual Funds

Dec 31, 2025

Our Mutual Fund Ranking Framework

Jan 19, 2026

Turn Mutual Funds Into Monthly Income (Part 3 - Key SWP Decisions)

Jan 19, 2026

Turn Mutual Funds Into Monthly Income (Part 2 - Systematic Withdrawal Plans - Reverse SIPs)

Jan 19, 2026

Turn Mutual Funds Into Monthly Income (Part 1 - Stocks Give Dividends, Mutual Funds Have IDCW)

Dec 5, 2025

Changes in Fund Manager - November 2025

Dec 4, 2025

Coffee with Creso: Spark more client conversations, one coffee at a time

Dec 1, 2025

You’ve Checked the Returns - But Have You Checked the Taxes? (Part 3 - Taxation for NRIs)

Jan 19, 2026

Going Global: How Indian Mutual Funds Let You Invest Beyond Borders

Nov 19, 2025

You’ve Checked The Returns, But Have You Checked The Taxes? (Part 2: Making Smarter Choices)

Nov 18, 2025

You’ve Checked the Returns, But Have You Checked the Taxes? (Part 1:The Basics)

Oct 14, 2025

How Clients Can Change Email or Mobile on MFCentral (Guide for MFDs)

Sep 3, 2025

GST 2025 for MFDs and Insurance Agents: What Changed, What Didn’t

Aug 28, 2025

How to Open a Minor’s Mutual Fund Account in India

Aug 3, 2025

Change of Broker in Mutual Funds

Partners in prosperity