Going Global: How Indian Mutual Funds Let You Invest Beyond Borders

Jan 19, 2026

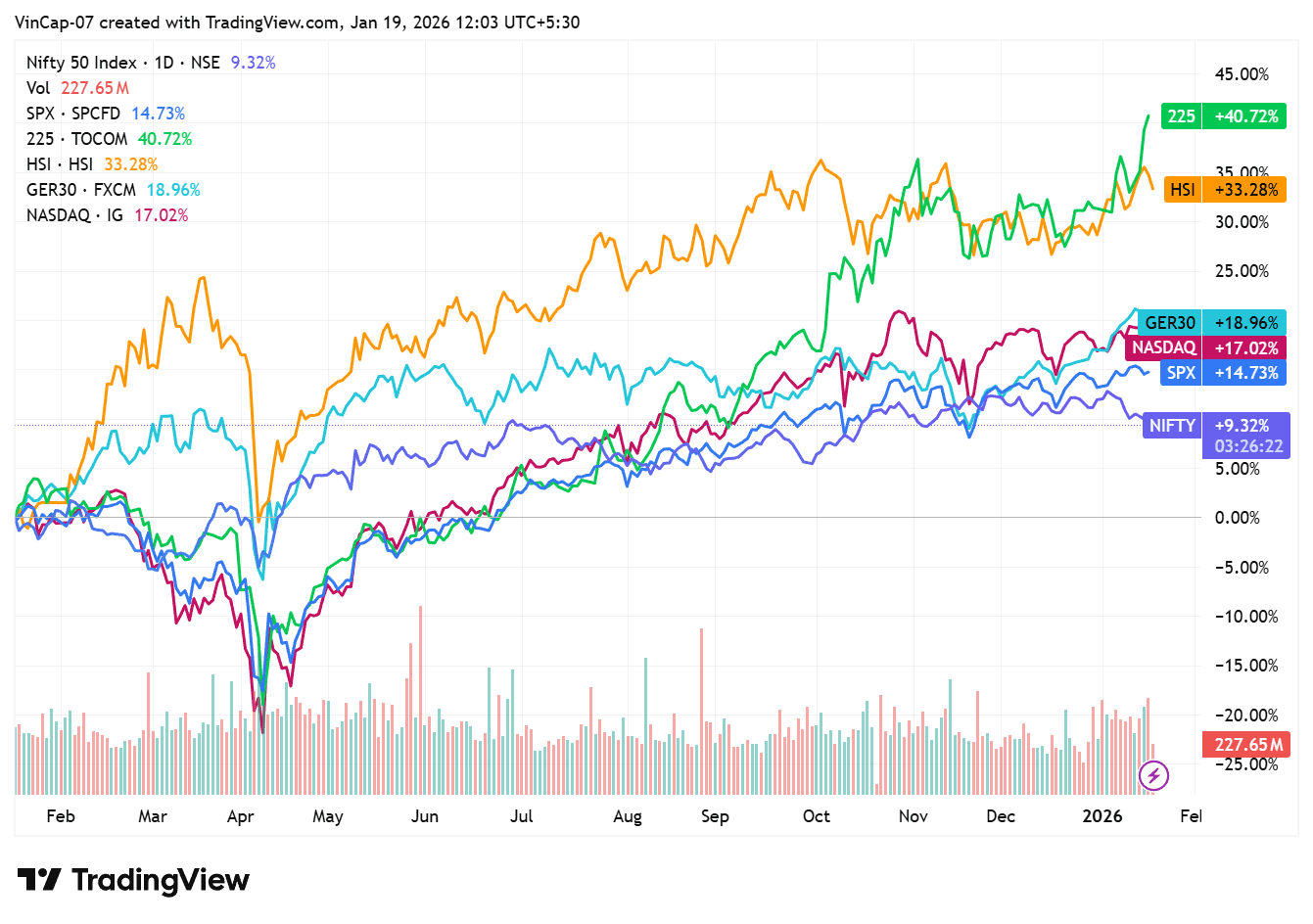

If you have been following global markets (or just reading the headlines!), you know they are doing well. In fact, some of the major global indices have sizably outperformed the Nifty over the past year. In this article, we will cover how an investor can gain exposure to global markets through mutual funds.

Why an investor should have allocation to global markets?

Major global indices like Nasdaq-S&P 500 (US), Hang Seng, DAX (Germany) and Nikkie 225 (Japan) have sizably outperformed the Nifty 50 in 2025, as seen below:

Exposure to these global indices can not only provide diversification benefits, but also act as a hedge against INR depreciation.

How can an investor participate in this?

Direct investing in global stocks. This will involve creating a foreign account and complicated remittance, tax and other regulations

Relatively smaller exposure through routine equity mutual funds, which can invest a small portion (< 35%) directly in overseas stocks

Via specific domestic mutual funds investing/tracking these global markets/indices through various schemes (which we discuss in detail below)

Tell me more about the last option

These are mutual fund schemes by Indian AMCs, which provide their investors access to international markets by investing in internatioal ETFs, index funds or feeder funds (and occasionally, directly investing in stocks). These schemes have already garnered an AUM of ₹50,000cr+, with a sizable exposure in US centric schemes.

These mutual funds can generally be further broken down into the following types:

Global Index Funds (tracking indices like MSCI World)

Emerging Market Funds

US-focussed Funds

Country or Region Specific Funds (Europe, Japan, Asia)

Thematic/sector funds (AI, tech, energy, consumption)

An illustrative list of such schemes with AUM of ₹2,000cr+ is as follows

Fund Name | AUM (₹ cr.) | TER | Rolling Return (3-yr) | Standard Deviation (3-yr) |

|---|---|---|---|---|

Motilal Oswal Nasdaq 100 | 6,159 | 0.58% | 19.25% | 21.20% |

Franklin U.S. Opps | 4,460 | 1.54% | 11.88% | 16.14% |

Motilal Oswal S&P 500 | 4,103 | 1.14% | 14.87% | 11.90% |

Kotak US Specific Equity | 3,767 | 0.91% | N/A | 16.46% |

Edelweiss US Technology | 3,640 | 2.39% | 15.01% | 24.97% |

ICICI Pru US Bluechip | 3,521 | 2.00% | 12.80% | 14.43% |

ICICI Pru NASDAQ 100 | 2,621 | 1.07% | N/A | 15.51% |

Edelweiss Greater China | 2,559 | 2.40% | -5.10% | 20.29% |

Mirae Asset NYSE FANG+ | 2,355 | 0.45% | N/A | 23.97% |

* Data as of 16 January 2026 sourced from Morningstar.

Check out Creso for a comprehensive list of overseas funds, for recommendations to clients

Things to keep in mind

Fund Availability: RBI regulations impact AMC’ ability to accept new investments in its international schemes, as some might pause inflows based on regulatory limits. Hence there may be limited time windows to invest and the option of SIPs may not be always available. Conversely, for predictability of foreign outflows (to comply with regulations), some AMCs accept only SIPs.

Currency Risk: A depreciating rupee can enhance gains but also increase risk, as currency fluctuations can work both ways and can impact your overall returns.

Fund objective: The fund’s investment strategy, target geography, expense ratio, and past performance, needs to be thoroughly evaluated.

Tax implications: Tax rules for foreign mutual funds differ from those for domestic ones. It is recommended to consult with your tax advisor. Brief comparison on taxability with domestic equity fund is as under:

Parameter | International Mutual Funds | Domestic Equity Mutual Funds |

|---|---|---|

Holding period for LTCG | 24 months | 12 months |

STCG Tax Rate | Slab Rate | 20% |

LTCG Tax Rate | 12.5% | 12.5% |

LTCG Exemption Limit | None | ₹1.25 Lakhs per year |

STT Applicability | No | Yes |

Tracking Error: The 2-layer expenses (Indian AMC plus foreign Fund of Funds) and foreign exchange fluctuations (including related hedging costs, if any), can imply a higher tracking error (in either direction). Simply put, the return on these mutual funds may be higher or lower than the underlying global benchmark (that the fund is tracking) due to these expenses and foreign exchange rate fluctuations.

Disclaimer: This blog has been written solely for educational purposes. The schemes mentioned herein are only examples and should not be construed as recommendations/investment advice. Readers should conduct their own research and assessments, to form an independent opinion about investment decisions.

Mutual fund investments are subject to market risks, read all the related documents carefully before investing.

FAQs

Q: What are international mutual funds?

A: International mutual funds are schemes that invest primarily in foreign equities or global markets. They may focus on a single country (e.g., U.S.) or a region (e.g., Asia-Pacific) or follow a global index/theme.

Q: How do international mutual funds work?

A: Indian AMCs usually invest via:

Feeder Funds – The Indian fund invests in an offshore parent fund (e.g., Motilal Oswal NASDAQ 100 FOF).

ETFs – Fund may track an international ETF.

Direct Global Stocks – Rare; fund buys foreign stocks directly

Q: What are the benefits of investing in international mutual funds?

A: Geographical diversification, access to global leaders (Apple, Microsoft, Tesla, etc.), hedge against INR depreciation, exposure to sectors under-represented in India (AI, semiconductors, biotechnology, etc.).

Q: What are the risks?

A: Currency risk, geopolitical risks, tax inefficiency, volatility due to global economic factors, limits imposed by RBI/SEBI may temporarily stop fresh investments in some funds.

Q: Is there an investment limit for Indians in international funds?

A: Yes, due to RBI’s LRS cap and SEBI rules:

AMC-level limits apply, and sometimes funds pause fresh inflows.

Investor-wise: No direct limit for mutual fund investments within India

Q: International funds are suitable for which type of investors?

A: Better suited for aggressive or balanced long-term investors. Conservative investors can avoid exposure to these funds

Q: Do they have high expense ratios?

A: Yes, feeder funds may have two layers of expense:

Indian AMC expense

Offshore fund expense

Q: What is the difference between global ETFs and international mutual funds?

A: Global ETFs trade on Indian exchanges (e.g., Motilal Oswal NASDAQ ETFs); and feeder funds are regular mutual funds that invest in global funds. ETFs require a Demat account; mutual funds don’t.

Q: How do currency movements affect returns?

A: If the INR depreciates against a foreign currency (e.g., USD), your returns increase.

If INR appreciates, returns decrease.

Q: Can I hedge currency risk?

A: Directly, no for retail mutual fund investors. Currency risk is part of the product

Q: Are these funds regulated?

A: Yes, by SEBI, and indirectly impacted by RBI’s LRS limits on foreign investments by AMCs

Read more from our Blogs

Feb 18, 2026

The Modern Gold Rush: Part III - The Silent Thieves – Hidden Costs, Tracking Errors, and the FOMO Trap

Feb 17, 2026

The Modern Gold Rush: Part II - The Art of the Mix – How Much Gold is Too Much?

Feb 16, 2026

The Modern Gold Rush: Part I – Why Your Locker may be the Wrong Place for Your Wealth

Feb 2, 2026

The Union Budget 2026 - Takeways for Mutual Fund Distributors

Jan 28, 2026

Decoding Debt Mutual Funds (Part III – The Decision Making)

Jan 27, 2026

Decoding Debt Mutual Funds (Part II - Where they stand in the fixed income landscape?)

Jan 26, 2026

Decoding Debt Mutual Funds (Part 1 – The Basics)

Jan 27, 2026

The Retail Tsunami: Dissecting 6 Years of Mutual Fund Growth (2019-2025)

Jan 5, 2026

Changes in Fund Manager - December 2025

Dec 26, 2025

Know Your Mutual Fund House (SBI MF)

Dec 24, 2025

The Long Road to “Mutual Funds Sahi Hai” – A History of Mutual Funds

Jan 16, 2026

Less Is More: A Simple Take on Focused Mutual Funds

Dec 31, 2025

Our Mutual Fund Ranking Framework

Jan 19, 2026

Turn Mutual Funds Into Monthly Income (Part 3 - Key SWP Decisions)

Jan 19, 2026

Turn Mutual Funds Into Monthly Income (Part 2 - Systematic Withdrawal Plans - Reverse SIPs)

Jan 19, 2026

Turn Mutual Funds Into Monthly Income (Part 1 - Stocks Give Dividends, Mutual Funds Have IDCW)

Dec 5, 2025

Changes in Fund Manager - November 2025

Dec 4, 2025

Coffee with Creso: Spark more client conversations, one coffee at a time

Dec 1, 2025

You’ve Checked the Returns - But Have You Checked the Taxes? (Part 3 - Taxation for NRIs)

Nov 19, 2025

You’ve Checked The Returns, But Have You Checked The Taxes? (Part 2: Making Smarter Choices)

Nov 18, 2025

You’ve Checked the Returns, But Have You Checked the Taxes? (Part 1:The Basics)

Oct 14, 2025

How Clients Can Change Email or Mobile on MFCentral (Guide for MFDs)

Sep 3, 2025

GST 2025 for MFDs and Insurance Agents: What Changed, What Didn’t

Aug 28, 2025

How to Open a Minor’s Mutual Fund Account in India

Aug 3, 2025

Change of Broker in Mutual Funds

Partners in prosperity