The Retail Tsunami: Dissecting 6 Years of Mutual Fund Growth (2019-2025)

Jan 27, 2026

If you are a Mutual Fund Distributor in India today, you are standing in the middle of a financial revolution. We often hear about the "financialization of savings" and the "rise of the retail investor," but what do the numbers really say?

We have analyzed consolidated Asset Under Management (AUM) and folio data from Sep’19 to Sep’25. The results are not just encouraging; they are a testament to the hard work you, the distribution community, have put in over the last several years.

Some key trends that we observed:

The Asset Explosion - Retail is Growing Faster than HNI

In Sept'19, the industry was already robust, but the last six years have been transformative.

Retail AUM has grown nearly 4 times from ₹5.2 lakh crores in Sep'19 to ₹20.8 lakh crore in Sep'25. HNI* AUM, on the other hand, has grown around 3 times from ₹8.9 lakh crore to ₹26.2 lakh crore.

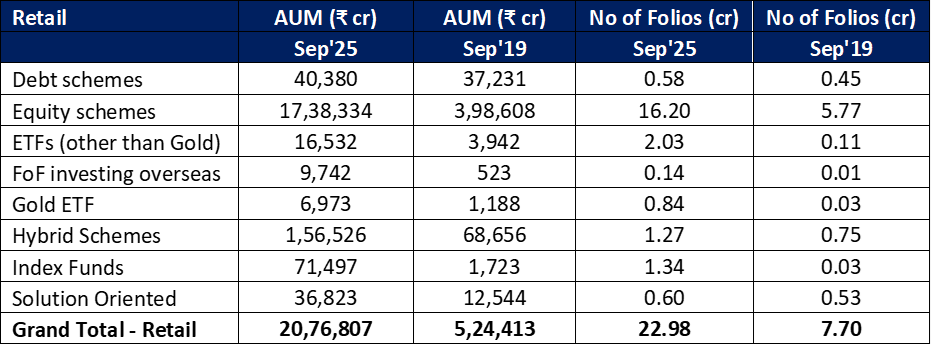

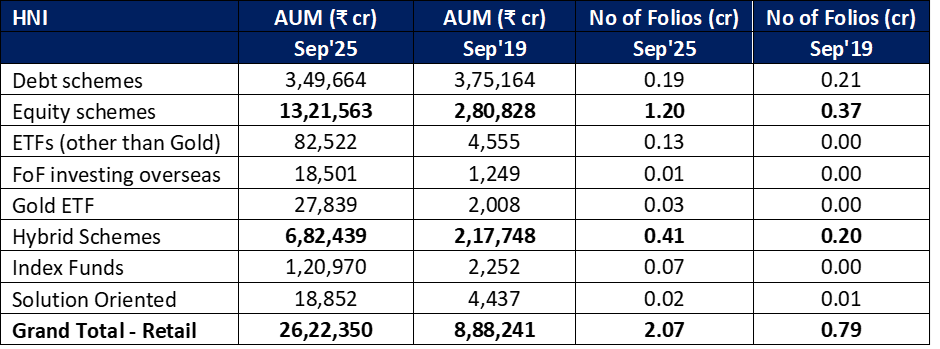

While HNIs still hold a larger absolute AUM, the velocity of growth is on the retail side. Category-wise data for retail and HNI investors below:

Retail:

HNI:

* HNI = High Net Worth Individuals, defined as individuals investing ₹2 lakhs and above.

Source: AMFI data

Equity Oriented Schemes: The Retail Fortress?

When we isolate equity-oriented schemes, the retail dominance becomes undeniable with retail equity AUM skyrocketing from ₹4 lakh cr to ₹17.4lakh cr by Sep’25, a staggering ~4.5x growth.

The folio growth among retail investors indicates wider participation from the masses, because of key campaigns like ‘Mutual Funds Sahi Hai’ and the rally in the stock markets.

Hybrid Schemes: The HNI Safe Haven?

A fascinating trend emerges when we look at hybrid schemes (including Balanced Advantage, Aggressive Hybrid, Arbitrage, etc.). HNIs control ~66% of the Hybrid AUM pie, compared to Retail's ~15% and this also corresponds to HNI AUM growth in hybrid schemes by ~3x, while Retail grew by ~2.2x.

As wealth grows, the need for preservation and lower volatility increases. HNIs and their distributors are likely using Dynamic Asset Allocation and Hybrid funds to manage risk on large corpuses, whereas retail investors are still in the "accumulation phase," prioritizing pure growth via equity.

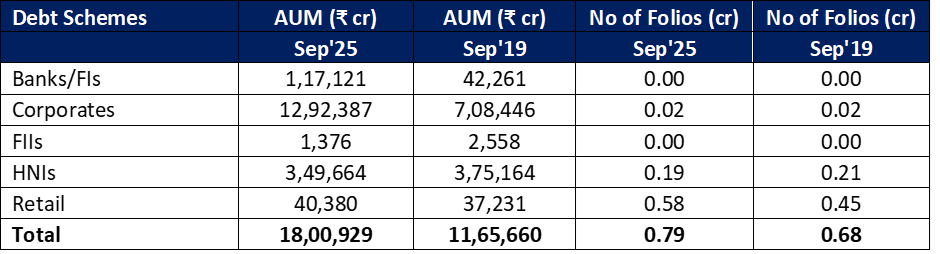

Corporates continue to gobble up on debt schemes

Corporates are parking money in debt schemes as evident from the data below. This could largely represent treasury operations of corporates and parking surplus funds for relatively short period of time – as corporates have grown with the economy, so has the absolute AUM in debt schemes held by them.

Source: AMFI data

Rise of passive investing

Another interesting observation is the increasing share of passive investing. For retail investors, the AUM in Index Funds and ETFs (excluding Gold ETFs) in Sep'19 was ~1.4% of the Total Equity AUM (defined as active equity schemes plus index funds and ETFs, but excluding hybrid funds and gold ETFs). In Sep'25, this increased to ~4.8%. For HNI investors, this increased from ~2.4% to ~13.3%.

To conclude,

The story of the last 6 years is one of divergence. Retail investors are conquering the Equity landscape with sheer volume and SIP discipline. Meanwhile, HNIs are quietly consolidating wealth in Hybrid and Debt strategies. Understanding these distinct behaviours is key to growing your distribution practice in 2026 and beyond.

To handle retail volumes (led by SIPs), you need efficient systems , and to handle the personalized high-value HNI clients, you need user friendly data/interface and reports. This is exactly where Creso fits in, to seamlessly offer services to clients using its simplified tech-first platform.

Read more from our Blogs

Feb 2, 2026

The Union Budget 2026 - Takeways for Mutual Fund Distributors

Jan 28, 2026

Decoding Debt Mutual Funds (Part III – The Decision Making)

Jan 27, 2026

Decoding Debt Mutual Funds (Part II - Where they stand in the fixed income landscape?)

Jan 26, 2026

Decoding Debt Mutual Funds (Part 1 – The Basics)

Jan 5, 2026

Changes in Fund Manager - December 2025

Dec 26, 2025

Know Your Mutual Fund House (SBI MF)

Dec 24, 2025

The Long Road to “Mutual Funds Sahi Hai” – A History of Mutual Funds

Jan 16, 2026

Less Is More: A Simple Take on Focused Mutual Funds

Dec 31, 2025

Our Mutual Fund Ranking Framework

Jan 19, 2026

Turn Mutual Funds Into Monthly Income (Part 3 - Key SWP Decisions)

Jan 19, 2026

Turn Mutual Funds Into Monthly Income (Part 2 - Systematic Withdrawal Plans - Reverse SIPs)

Jan 19, 2026

Turn Mutual Funds Into Monthly Income (Part 1 - Stocks Give Dividends, Mutual Funds Have IDCW)

Dec 5, 2025

Changes in Fund Manager - November 2025

Dec 4, 2025

Coffee with Creso: Spark more client conversations, one coffee at a time

Dec 1, 2025

You’ve Checked the Returns - But Have You Checked the Taxes? (Part 3 - Taxation for NRIs)

Jan 19, 2026

Going Global: How Indian Mutual Funds Let You Invest Beyond Borders

Nov 19, 2025

You’ve Checked The Returns, But Have You Checked The Taxes? (Part 2: Making Smarter Choices)

Nov 18, 2025

You’ve Checked the Returns, But Have You Checked the Taxes? (Part 1:The Basics)

Oct 14, 2025

How Clients Can Change Email or Mobile on MFCentral (Guide for MFDs)

Sep 3, 2025

GST 2025 for MFDs and Insurance Agents: What Changed, What Didn’t

Aug 28, 2025

How to Open a Minor’s Mutual Fund Account in India

Aug 3, 2025

Change of Broker in Mutual Funds

Partners in prosperity